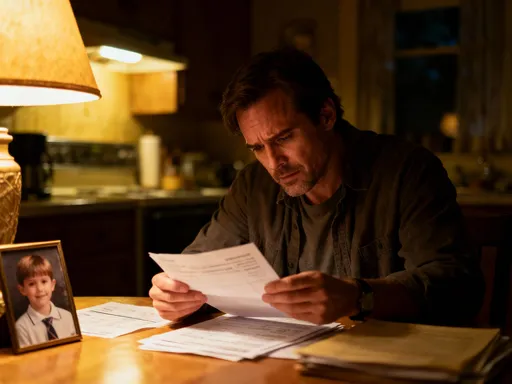

How I Protected My Kid’s Education Fund Without Falling for the Hype

Setting up an education fund felt overwhelming at first—everyone had advice, but not all of it helped. I made some costly mistakes early on, from chasing flashy returns to misjudging risks. Over time, I learned what actually works: smart money management, realistic planning, and avoiding common traps. This is my story of protecting my child’s future while staying grounded, practical, and in control of our finances. What began as a well-meaning but chaotic effort evolved into a disciplined, informed strategy that prioritized stability over spectacle. Along the way, I discovered that the most effective financial decisions are rarely the loudest or most promoted ones. Instead, they are rooted in patience, clarity, and a commitment to long-term security rather than short-term gains.

The Pressure to Start Early—And the Panic That Follows

From the moment my child was born, the message was clear: start saving now. Relatives, financial ads, even pediatricians subtly reinforced the idea that delaying education savings was a parental failure. I internalized that pressure quickly. Within months, I opened an investment account marketed specifically for children, convinced that early action equated to responsibility. The plan promised double-digit annual growth, glossy brochures showing smiling graduates, and a sense of security that felt almost tangible. But I didn’t pause to examine the fine print or question whether the projected returns were realistic. I acted out of fear—fear of falling behind, fear of burdening my child with debt, fear of being unprepared. That emotional urgency clouded my judgment and led me straight into a high-cost, underperforming product.

What I didn’t realize at the time was that the most dangerous financial decisions often stem not from ignorance alone, but from urgency layered on top of good intentions. The financial industry is well aware of this emotional leverage and tailors many education-focused products to exploit it. These plans are frequently wrapped in reassuring language, promising peace of mind while quietly embedding fees and restrictions that benefit the provider more than the saver. My initial fund charged a 3% front-end load, meaning a significant portion of every dollar I contributed disappeared before it even began to grow. Annual management fees hovered around 1.8%, far above the market average for similar instruments. Over a decade, those costs compounded into thousands of dollars lost—money that could have covered textbooks, lab fees, or even a semester abroad.

Looking back, the real lesson wasn’t just about costs—it was about timing. Starting early is wise, but starting blindly is risky. A more effective approach would have been to take three to six months to research options, compare fee structures, and consult fee-only advisors who had no incentive to sell a specific product. By allowing myself that breathing room, I could have separated marketing from substance. Instead, I let anxiety dictate my actions and paid the price. The irony is that slowing down would have served my child’s future far better than rushing in. True financial responsibility isn’t measured by how quickly you open an account, but by how thoughtfully you design it.

Why Not All Investment Vehicles Are Built for Education Goals

One of the biggest misconceptions I held early on was that higher risk automatically meant higher reward—and therefore, greater security for my child’s education. Armed with that belief, I allocated a large portion of the fund to an equity mutual fund with a strong five-year track record. It was marketed as “growth-oriented,” and at first, the returns seemed impressive. Annual gains of 9% and 11% made me feel like I was getting ahead. But what I failed to account for was timing. Education expenses are not flexible. Whether tuition is due in 10 years or 2 years, the bill arrives on schedule. Unlike retirement, which can be delayed, education funding has a hard deadline. When the market corrected sharply just 18 months before my child was set to enroll, the portfolio dropped by nearly 22%. Suddenly, those paper gains evaporated, and I faced the prospect of withdrawing funds at a loss.

This experience taught me a fundamental principle: the right investment depends not just on expected returns, but on the time horizon and purpose of the goal. Education savings are what financial planners call “time-sensitive liabilities.” That means the money must be available when needed, with minimal volatility. Aggressive growth funds, while suitable for long-term goals like retirement, are poorly matched to this requirement. As the target date approaches, the risk of a market downturn can derail years of disciplined saving. A better approach is to use a “lifecycle” or “age-based” strategy, where the portfolio gradually shifts from higher-risk assets like stocks to more stable instruments like bonds and fixed-income products as the child gets older.

After my setback, I restructured the fund using a tiered approach. For the first decade, I allowed moderate exposure to equities through low-cost index funds, accepting some volatility in exchange for growth potential. But as my child entered middle school, I began transitioning a larger share into government-backed savings bonds and high-quality corporate bonds. By high school, the majority of the fund was in capital-preserving assets, ensuring that the principal was protected even if growth slowed. I also explored dedicated education savings accounts where available, which offered tax advantages and withdrawal flexibility for qualified expenses. The key was alignment: matching the risk profile of the investment to the proximity of the expense. It wasn’t the most exciting strategy, but it was the most reliable.

Hidden Fees and the True Cost of “Expert” Advice

I used to believe that paying for professional financial advice was a sign of responsibility. If I was willing to invest in my child’s future, shouldn’t I also invest in expert guidance? That logic led me to a financial advisor who presented himself as a specialist in family wealth planning. He recommended a bundled education plan that combined insurance, investment, and savings components. It sounded comprehensive, even sophisticated. He emphasized the benefits: guaranteed payouts, tax efficiency, and automatic enrollment in scholarship networks. What he downplayed were the fees—layers of charges that quietly eroded the fund’s value year after year. There was an annual management fee of 1.5%, a 2.25% administrative surcharge, and a steep surrender penalty if I wanted to exit within the first seven years. Even the insurance component, which I didn’t fully need, came with a recurring cost built into the structure.

It took me nearly five years to realize how much I was losing. A simple comparison revealed that a similar portfolio of low-cost index funds would have cost less than 0.3% annually. The difference? Over 1.9% in lost returns every single year. Compounded over a decade, that gap amounted to more than 25% of the fund’s potential growth. In dollar terms, it was the equivalent of an entire year of tuition at a public university. I hadn’t gained peace of mind—I’d bought convenience at an exorbitant price. The plan’s complexity made it difficult to track performance, and the advisor was more focused on retention than transparency. When I finally requested a full cost breakdown, it arrived in dense, jargon-filled documents that obscured rather than clarified.

This experience reshaped my view of financial advice. Not all advisors are equal, and not all guidance is in the client’s best interest. Commission-based models, where advisors earn money from selling specific products, create inherent conflicts of interest. A more trustworthy alternative is a fee-only fiduciary advisor, who charges a flat rate or hourly fee and has a legal obligation to act in the client’s best interest. For many families, especially those with straightforward goals, even that may not be necessary. A growing number of low-cost, transparent platforms now offer automated portfolio management with clear fee disclosures and no hidden charges. The lesson I learned was this: financial expertise should empower you, not confuse you. If a plan is too complex to understand, it’s probably too costly to justify.

The Liquidity Trap: When Your Money Is Locked In

One of the most stressful moments in my journey came not from market fluctuations, but from a lack of access. My child was accepted into a summer enrichment program at a prestigious university—a fantastic opportunity that required a $3,000 payment within 10 days. The program could strengthen college applications and open doors to future scholarships. I knew we had the money saved, but when I tried to withdraw a portion of the fund, I was hit with a 7% early withdrawal penalty and a two-week processing delay. The account was structured as a long-term, illiquid vehicle with strict rules about disbursements. Even partial withdrawals triggered fees, and non-qualified expenses were heavily discouraged. I ended up using a credit card to cover the cost, accruing interest that took months to pay off. The irony was painful: I had saved diligently, yet when a real educational need arose, the system worked against me.

Liquidity—the ability to access funds when needed—is one of the most overlooked aspects of education planning. Many savings vehicles are designed for long-term growth but come with rigid structures that limit flexibility. Locking money away may protect it from impulsive spending, but it also removes your ability to respond to opportunities or emergencies. A truly resilient education fund should balance growth with accessibility. That doesn’t mean keeping everything in a checking account, but it does mean avoiding products that impose excessive penalties or bureaucratic hurdles for withdrawals.

To fix this, I restructured the fund into two tiers: a core growth component and a liquid reserve. The majority of savings remained in diversified, long-term investments, but I allocated about 15% to a high-yield savings account and short-term certificates of deposit. These instruments offered modest returns but allowed immediate access without penalties. I also ensured that withdrawals for qualified education expenses were streamlined, using accounts that integrated with tuition billing systems. This hybrid approach gave me peace of mind: the bulk of the fund continued to grow, while a portion remained readily available for time-sensitive needs. Liquidity isn’t a luxury—it’s a necessity in any practical financial plan.

Inflation vs. Real Returns—What You’re Actually Earning

For years, I celebrated my fund’s 6% average annual return as a success. It sounded strong, especially compared to savings accounts yielding less than 1%. I proudly shared the number with family, believing we were on track. But then I started paying closer attention to the cost of college. Over the same period, tuition at public universities had increased by 5.2% per year, and private institutions were rising even faster. That meant my “successful” return was barely outpacing inflation. My real, inflation-adjusted gain was just 0.8% annually—not enough to maintain purchasing power, let alone get ahead. I had been measuring performance in nominal terms, but what mattered was real value. A dollar saved today must cover more expensive bills tomorrow, and if returns don’t exceed inflation, the fund is effectively shrinking in practical terms.

Inflation is the silent thief of long-term savings. It doesn’t show up as a fee or penalty, but it steadily reduces what your money can buy. Over 18 years, even a 3% annual inflation rate can more than double the cost of education. That means a fund growing at 4% per year is only delivering 1% in real terms—a dangerously narrow margin. To truly protect purchasing power, education savings must target returns that consistently exceed inflation by a meaningful margin. That requires a balanced mix of growth-oriented assets early on, combined with periodic rebalancing to manage risk as the goal approaches.

I responded by reassessing my asset allocation. I increased exposure to equity index funds with a history of outperforming inflation over the long term, while maintaining a core of inflation-protected securities like Treasury Inflation-Protected Securities (TIPS). I also began tracking tuition trends in my region, adjusting my savings targets annually to reflect actual cost increases. This shift from nominal to real return thinking transformed my approach. Instead of being satisfied with any positive number, I focused on whether the fund was keeping pace with reality. Financial success isn’t just about growth—it’s about relevance.

Balancing Today’s Needs With Tomorrow’s Goals

At one point, determined to maximize the education fund, I made a decision that nearly backfired. I redirected every spare dollar toward the account, even draining our emergency fund to make a large lump-sum contribution. I told myself it was a short-term sacrifice for a long-term gain. But just three months later, my spouse needed minor surgery that wasn’t fully covered by insurance. We had no cash buffer, no accessible savings, and no choice but to put the $4,500 bill on a high-interest credit card. The stress was immense, and the interest charges quickly erased any gains we’d made in the education account. That experience was a wake-up call: you cannot build a secure future by destabilizing the present.

True financial health is holistic. It requires balancing multiple priorities: saving for education, maintaining an emergency fund, managing debt, and ensuring adequate insurance coverage. Overemphasizing one goal at the expense of others creates fragility. An education fund is important, but it shouldn’t come at the cost of daily stability. A medical emergency, job loss, or home repair can quickly undo years of disciplined saving if there’s no safety net in place. The most effective financial plans are not the most aggressive—they are the most balanced.

I rebuilt our strategy around proportional allocation. Instead of funneling everything into one account, I established clear percentages for each priority: 50% to living expenses, 20% to long-term savings (including education), 15% to emergency savings, and 10% to debt reduction and insurance. This framework ensured that no single goal dominated our budget. I also automated contributions so that each category received consistent funding without requiring constant attention. By protecting today’s stability, I created a stronger foundation for tomorrow’s goals. Sacrifice has a place in financial planning, but reckless sacrifice undermines the very security we’re trying to build.

Building a Smarter, More Resilient Education Fund

After years of missteps and adjustments, I finally developed a strategy that felt sustainable, transparent, and aligned with our family’s real needs. The new approach was built on three pillars: simplicity, cost efficiency, and regular review. I moved the bulk of the fund into low-cost index-tracking exchange-traded funds (ETFs) that provided broad market exposure without the high fees of actively managed funds. These instruments have historically delivered strong long-term returns with minimal drag from expenses. I diversified across asset classes—U.S. equities, international stocks, and investment-grade bonds—and structured the allocation to become more conservative as my child approached college age.

I also implemented a system of annual reviews, where I assessed performance, adjusted contributions based on income changes, and rebalanced the portfolio to maintain target allocations. This wasn’t about chasing trends or reacting to market noise—it was about disciplined course correction. I set up automatic transfers from our checking account, ensuring consistent savings without relying on willpower. And I prioritized accounts with clear withdrawal rules, low fees, and tax advantages for education expenses.

Most importantly, I let go of the need for perfection. I no longer expect to cover 100% of future costs, nor do I believe that any single decision will make or break my child’s future. What matters is consistency, awareness, and adaptability. The goal isn’t to eliminate all risk—that’s impossible—but to manage it wisely. By focusing on what I can control—fees, behavior, planning—I’ve gained confidence that we’re doing our best without falling for the hype. Financial security isn’t found in flashy promises or complex products. It’s built quietly, over time, through thoughtful choices and steady effort. And that, I’ve learned, is the most valuable lesson I can pass on.