Single Parent, Smart Investor: My Market Moves Without the Jargon

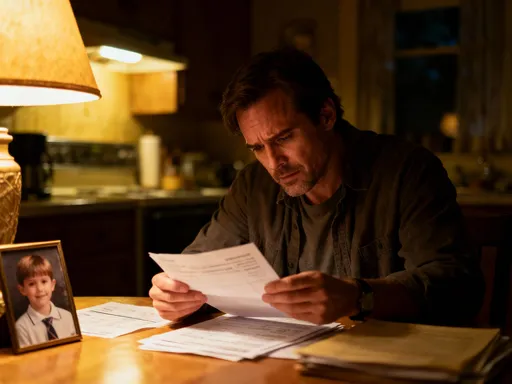

Raising kids alone while trying to grow your money? I’ve been there—staring at bills, wondering how to start investing without a finance degree. It felt overwhelming. But after testing strategies, making mistakes, and finally finding what works, I realized market analysis isn’t just for experts. With the right mindset and simple tools, single parents can build financial stability. Let me show you how. This journey isn’t about chasing quick wins or memorizing complex charts. It’s about making steady, informed choices that protect your family and open doors for the future. You don’t need a six-figure income—just clarity, consistency, and confidence in small steps that add up.

The Reality Check: Why Single Parents Face Unique Financial Pressures

Single-parent households carry a financial burden that extends far beyond emotional or logistical challenges. According to data from the U.S. Census Bureau, nearly 80% of single-parent families in the United States are led by mothers, and many operate on a single income while managing the full cost of housing, childcare, education, and healthcare. The economic reality is stark: these families often face an income gap that makes wealth-building seem out of reach. While dual-income households may split expenses and savings responsibilities, single parents bear the full weight alone, limiting their ability to save, invest, or recover from unexpected setbacks.

This financial pressure is compounded by time scarcity. Juggling work schedules, school drop-offs, extracurricular activities, and household duties leaves little room for financial planning. Many single parents report feeling too exhausted to even open their bank statements, let alone research investment options. As a result, emergency savings are often minimal, and reliance on credit cards or short-term loans becomes common during crises. A 2023 Federal Reserve report found that only 43% of single-parent households could cover a $400 emergency expense with cash or savings, compared to 60% of two-parent families. This gap isn’t just about income—it reflects systemic barriers to financial education, access to affordable childcare, and employer-supported benefits like flexible hours or retirement plans.

Traditional financial advice often fails this demographic because it assumes stability, disposable income, and time—resources many single parents simply don’t have. Generic recommendations like “save 20% of your income” or “invest in real estate” can feel alienating when monthly expenses consume every dollar. Yet, the need for long-term planning is even more urgent. Without a second earner, the risk of falling into financial crisis due to job loss, illness, or rising living costs is significantly higher. Therefore, building financial resilience isn’t a luxury—it’s a necessity. The key lies not in drastic measures but in redefining what’s possible within real-life constraints. By focusing on small, sustainable actions and leveraging accessible tools, single parents can begin to close the gap between survival and security.

Market Analysis Demystified: What It Really Means for Everyday Investors

When most people hear “market analysis,” they picture stock traders in front of flashing screens, shouting orders and tracking complex indicators. But for everyday investors—especially single parents with limited time and resources—market analysis doesn’t need to be intimidating. At its core, market analysis is simply the process of understanding how different investments behave based on economic trends, company performance, and broader financial conditions. It’s not about predicting the next big crash or finding hidden stock gems; it’s about making smarter decisions with the money you already have.

There are two main approaches: top-down and bottom-up. A top-down approach starts with the big picture—global economies, interest rates, inflation, and industry trends—then narrows down to specific investment opportunities. Think of it like planning a road trip: you first decide which region you want to visit, then choose the best route and stops along the way. For example, if economic data shows that technology sectors are growing due to increased digital adoption, a top-down investor might consider funds focused on tech companies. This method helps align investments with broader economic shifts, which can be especially useful for long-term planning.

On the other hand, a bottom-up approach focuses on individual companies or assets. It’s like shopping for groceries—you examine each item based on quality, price, and need, regardless of the store’s overall reputation. An investor using this method might research a specific company’s earnings, leadership, and growth potential before deciding to buy its stock. While this takes more time and research, it allows for targeted decisions based on personal confidence in a particular business.

For single parents, combining both perspectives offers balance. You don’t need to master either fully—just understand enough to avoid impulsive choices. Market analysis becomes powerful when used to answer simple questions: Is this investment aligned with my goals? Does it fit my risk tolerance? How does it respond to changes in the economy? Over time, this awareness builds confidence. You begin to see the market not as a casino, but as a system where informed choices lead to better outcomes. And the best part? You don’t need expensive tools or years of study. Free resources like government economic reports, reputable financial news outlets, and simple charting tools within investment apps provide all the insight most people need to get started.

Starting Small: Building Your First Investment Strategy on a Tight Budget

One of the biggest myths about investing is that you need thousands of dollars to begin. For single parents living paycheck to paycheck, this belief can be paralyzing. But the truth is, you can start building wealth with as little as a few dollars a week. The key is consistency, not size. Micro-investing platforms have revolutionized access to the markets, allowing users to invest spare change from everyday purchases. For instance, if you buy groceries for $47.85, an app might round up the transaction to $48 and invest the $0.15 difference. It seems insignificant at first, but over time, these small amounts accumulate and compound, especially when invested in diversified assets.

Index funds are another powerful tool for small-budget investors. These funds track major market benchmarks like the S&P 500 and offer instant diversification across hundreds of companies. Because they’re passively managed, they come with low fees—often less than 0.10% annually—making them far more cost-effective than actively managed funds. A single parent contributing $50 per month into a low-cost index fund, earning an average annual return of 7%, could accumulate over $10,000 in 10 years, even without increasing contributions. That kind of growth can cover a child’s college textbook costs, help with a car repair, or serve as a cushion during a job transition.

Automation is the secret ingredient that makes small investing sustainable. By setting up automatic transfers from a checking account to an investment account, you remove the need for constant decision-making. Treat it like a non-negotiable bill—just another part of your monthly budget. Many employers now offer automatic enrollment in retirement plans like 401(k)s, with options to start at 1% or 3% of salary. Even if you can’t max out contributions right away, starting small builds the habit. As income increases or expenses decrease, you can gradually raise your contribution rate. The power lies in momentum: once the system is in place, it works for you, even on busy days when finances are the last thing on your mind.

Consider Maria, a single mother of two working as a medical assistant. She began investing $25 per month through a workplace retirement plan and linked a micro-investing app to her debit card. Within a year, she had saved and invested nearly $600 without feeling financial strain. More importantly, she gained peace of mind knowing she was taking concrete steps toward her children’s future. Her story isn’t unique—it’s repeatable. Starting small doesn’t mean thinking small. It means respecting your current reality while actively shaping a better one.

Risk Control: Protecting Your Family’s Future Without Overthinking It

For single parents, the idea of investing often comes with anxiety. What if the market drops? What if I lose money needed for rent or groceries? These fears are valid, especially when your decisions directly impact your children’s well-being. But avoiding risk entirely isn’t the solution—it can lead to another kind of danger: financial stagnation. Inflation erodes purchasing power over time, meaning that money kept under the mattress or in low-interest savings accounts loses value. The goal isn’t to eliminate risk, but to manage it wisely so that your family remains protected even when markets fluctuate.

Diversification is the most effective risk-control strategy available to everyday investors. It means spreading your money across different types of assets—such as stocks, bonds, real estate, and cash—so that a loss in one area doesn’t wipe out your entire portfolio. Think of it like packing a child’s backpack for school: you include a snack, a water bottle, a sweater, and a notebook because you don’t know exactly what the day will bring. If it’s cold, the sweater helps. If they forget lunch, the snack saves the day. Similarly, when stocks decline during an economic downturn, bonds may hold steady or even rise, balancing the overall impact on your investments.

Another critical component of risk control is the emergency fund. Financial experts consistently recommend saving three to six months’ worth of essential expenses in a liquid, easily accessible account. For a single parent, this fund acts as a financial shock absorber, preventing the need to sell investments at a loss during a crisis. Imagine facing a sudden car repair or medical bill. Without savings, you might be forced to withdraw from a retirement account, incurring penalties and taxes. With an emergency fund, you can handle the expense without derailing long-term goals. Building this fund doesn’t require perfection—start with $500, then grow it gradually. Even a small buffer reduces stress and creates space for smarter financial decisions.

Understanding your risk tolerance is equally important. This isn’t just about how much volatility you can emotionally handle—it’s about aligning your investments with your life stage and responsibilities. A young single parent with decades until retirement can afford to take on more market risk because time allows for recovery from downturns. Someone nearing their child’s college years may prefer more stable, income-generating assets. Many online investment platforms offer risk assessment quizzes that help guide portfolio choices. The goal is balance: enough growth potential to outpace inflation, but enough stability to protect against major setbacks. When risk is managed intentionally, investing becomes less scary and more empowering.

Earning More Than Returns: How Smart Moves Create Long-Term Security

While everyone likes to see their account balance grow, the true value of investing goes far beyond dollar amounts. For single parents, consistent financial action builds something deeper: confidence, resilience, and a sense of control. Each contribution, no matter how small, sends a message: I am planning for my family’s future. Over time, this mindset shift becomes transformative. You stop seeing yourself as someone just getting by and start recognizing your power to create lasting change.

Compounding is the engine behind this transformation. It refers to the process where your investment earnings generate their own earnings over time. The earlier you start, the more powerful compounding becomes. For example, a single parent who begins investing $100 per month at age 30, with a 7% average annual return, could accumulate over $150,000 by age 60. If that same person waits until age 40 to start, the total drops to around $70,000—less than half. Time is the most valuable asset in wealth-building, and every year counts. This isn’t a promise of overnight riches; it’s a demonstration of how discipline today creates freedom tomorrow.

Long-term security also means being prepared for major life events. College tuition, home repairs, career transitions—these milestones require planning. By investing consistently, single parents can reduce reliance on loans or external help when these moments arrive. Imagine being able to pay for a portion of your child’s education without borrowing, or having the funds to relocate for a better job opportunity. These outcomes aren’t miracles—they’re the result of intentional choices made years in advance.

Moreover, this journey models financial responsibility for children. When kids see a parent budgeting, saving, and talking openly about money, they learn healthy habits early. They grow up understanding that money is a tool, not a source of shame or stress. This intergenerational impact may be the most valuable return of all. Financial clarity isn’t just about numbers—it’s about legacy. It’s about showing your children that resilience, planning, and hope can build a better future, even when the odds feel stacked against you.

Practical Tools and Habits: What Works When Time Is Scarce

Single parents don’t have the luxury of spending hours analyzing stock charts or reading financial reports. That’s why simplicity and automation are essential. The good news is that modern tools make it easier than ever to manage investments without becoming a finance expert. Robo-advisors, for example, use algorithms to build and manage diversified portfolios based on your goals and risk tolerance. You answer a few questions, link your account, and the system handles the rest—rebalancing, tax optimization, and ongoing adjustments. Fees are typically low, often under 0.50% per year, making them accessible and efficient.

Mobile apps also play a crucial role. Many brokerage platforms offer intuitive interfaces that allow you to track performance, adjust contributions, and receive alerts—all from your phone. Features like push notifications for market updates or automatic reminders to review your budget help keep you engaged without demanding large time commitments. Calendar alerts can be set for quarterly financial check-ins, ensuring you stay on top of your progress without constant monitoring.

Habits matter just as much as tools. One effective practice is the “quarterly review”—a 30-minute session every three months to assess your budget, investment performance, and goals. It’s not about making drastic changes; it’s about staying aligned. Did your income shift? Did a new expense arise? Is your emergency fund still adequate? These brief check-ins prevent small issues from becoming big problems. Another habit is the monthly expense audit: reviewing bank statements to identify unnecessary subscriptions or recurring charges. Even saving $20 a month can be redirected into an investment account, fueling long-term growth.

The goal is to design a system that works around your life, not the other way around. Automation ensures consistency. Simple tools reduce complexity. Regular habits maintain awareness. Together, they create a sustainable financial rhythm that fits the reality of single parenting. You don’t need perfection—just persistence. And the more these practices become routine, the more natural they feel, freeing up mental energy for what matters most: your family.

Beyond the Numbers: Financial Clarity as a Gift to Your Family

At its heart, financial planning is an act of love. Every dollar saved, every investment made, every budget reviewed is a step toward greater security for your children. It’s not about achieving wealth for its own sake, but about creating a stable foundation where your family can thrive. When you take control of your finances, you reduce stress, gain freedom, and model strength for your kids. They see that challenges can be met with calm, strategy, and hope.

Market awareness doesn’t require expertise—it requires intention. You don’t need to predict every economic shift or time the market perfectly. You just need to show up, make informed choices, and keep moving forward. Progress, not perfection, is the measure of success. Some months you’ll contribute more; others, you may pause. That’s okay. What matters is the long arc of your journey.

Financial clarity gives you options. It means being able to say yes to opportunities—a better home, a career change, a family vacation—without fear. It means facing the unexpected with preparation, not panic. And it means leaving a legacy of resilience, showing your children that with patience and purpose, a secure future is possible.

So start where you are. Use what you have. Do what you can. Whether it’s $5 a week or $50 a month, your actions matter. The market doesn’t reward speed—it rewards consistency. And as a single parent, you already possess the most important qualities for success: determination, care, and the courage to keep going. Let that be the foundation of your financial future. Because every small move you make today is a promise of stability, peace, and possibility for tomorrow.